NEW YORK — Narmi, a technology firm offering a unified platform for banks and credit unions, today announced the launch of Narmi Lend, a transformative lending solution designed to turn digital banking applications into powerful, always-on loan demand engines.

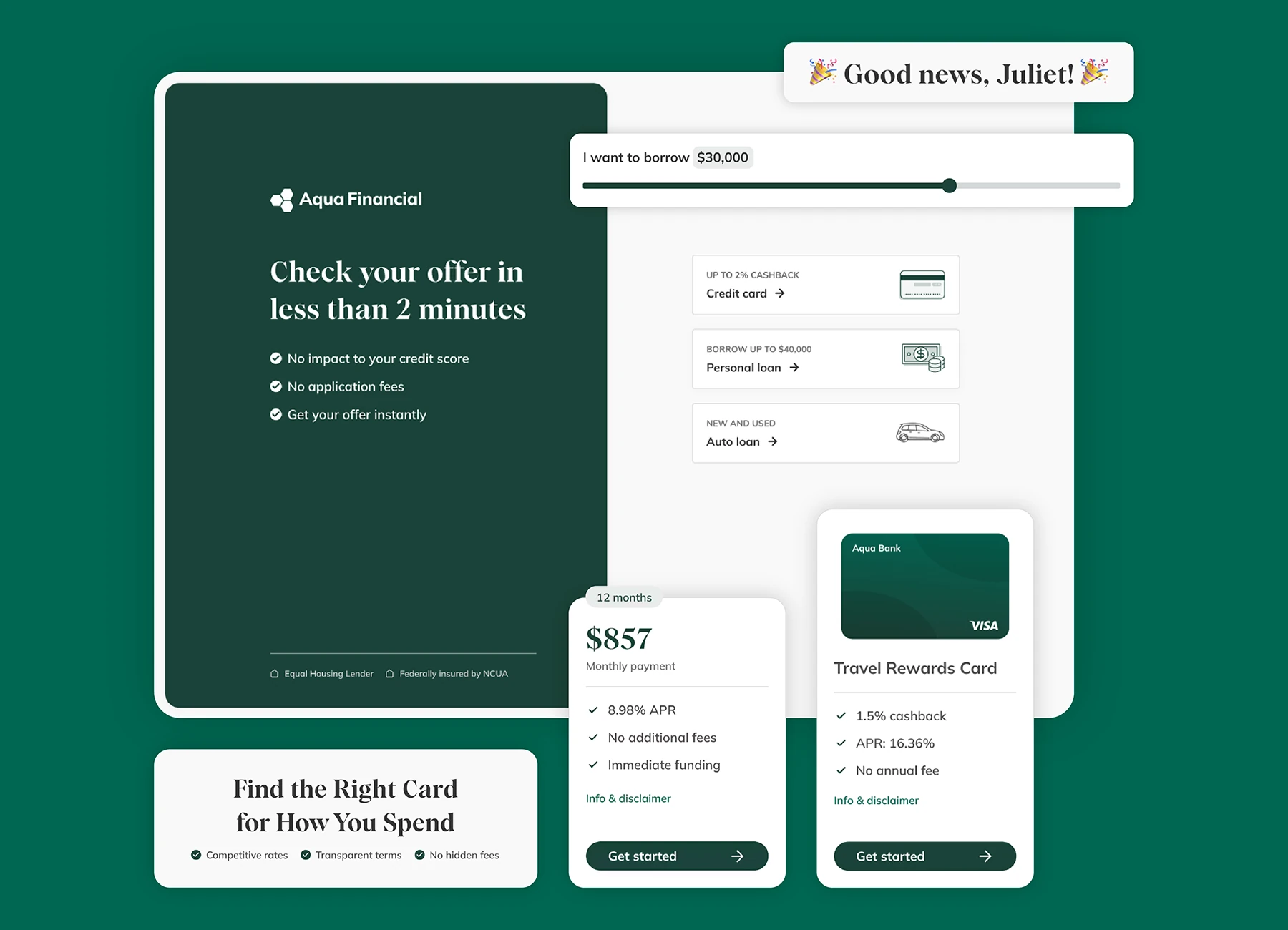

Narmi Lend’s core innovation is its ability to embed personalized, pre-qualified loan offers directly into the everyday digital banking experience. This eliminates the disjointed, fragmented borrower journeys that plague systems reliant on external links, third-party bolt-ons, or clunky application portals, thus decreasing abandonment rates and placing the lending flow within a seamless user experience.

Narmi Lend is the only next-gen lending solution built specifically into a homegrown, consolidated banking platform.

Creating Demand, Not Waiting for It

Often, the lending process for community banks and credit unions amounts to a reactive, isolated function, forcing borrowers to start from scratch and re-enter data in disparate systems. Legacy loan origination systems (LOS) and lending suites excel at back-end workflows but fail at top-of-funnel demand generation. Narmi Lend was built to address this gap.

Key Features of Narmi Lend:

“We built Narmi Lend to solve a core issue in banking: loan demand doesn’t emerge on its own,” said Chris Griffin, co-founder of Narmi. “Institutions need a way to surface relevant offers directly inside the digital experience, not through disconnected links or bolt-ons.

“Narmi Lend gives banks and credit unions a modern front end that actually generates demand and puts them on the same playing field as digital-only lenders that have been taking market share.”

Addresses A Common Lending Pain Point: Fragmentation

Narmi Lend is the seventh major pillar of the Narmi One platform, reinforcing the company's commitment to a single end-to-end platform for any banking customer’s journey. Narmi Lend’s tight integration with the platform’s deposits and banking functions results in seamless data flow across products, without the need for manual re-entry for both applicants and staff. The data is then surfaced into a single staff portal (Narmi Command), centralizing all information and bypassing the fragmentation occurring with linking separate vendors.

This unified approach includes adopting key partners like Alloy for real-time identity and fraud checks, as well as leveraging their innovative underwriting engine. Narmi and Alloy integrate with all three credit bureaus for your financial institution’s underwriting needs. This helps ensure robust data integrity and high-stakes fraud prevention (a critical capability often compromised in fragmented, multi-vendor environments), minimizes operational drag, accelerates speed-to-funding, and positions banks and credit unions to compete effectively against megabanks and fintechs.

“For years, banks and credit unions have been asking for lending tools that integrate cleanly with their core,” said Nikhil Lakhanpal, co-founder of Narmi. “With our initial release of Narmi Lend, applications write directly into Corelation Keystone and Symitar ELA in real time, providing members a seamless experience and staff a single, unified workflow.

“It strengthens existing core investments, reduces operational friction, and sets the stage for deeper lending capabilities across our platform.”

Seamless Integration for Corelation Keystone and Symitar ELA Users

Narmi Lend is launching with immediate, deeply integrated capabilities for credit unions utilizing Corelation Keystone and Symitar ELA LOS systems, with further core integrations set to launch soon.

Design partners Landings Credit Union, Orion Financial and Greater Alliance Credit Union are providing critical and invaluable feedback on the product’s functionality, user experience, and overall value, guiding the initial development and iteration of Narmi Lend.

“I think that Narmi taking the position to offer lending to their clients has been a very important strategic move,” said Sinaed Kuntzman, SVP of Member Experience at Orion Financial. “It allows us at Orion Financial to see how we can maintain our member relationships better, by leading them through integrated experiences that are contained inside of the loan application.”

This integration ensures a truly seamless digital lending experience, where pre-qualified applications are written directly to Corelation or Symitar systems for real-time funding and decisioning. This direct core connectivity bypasses the typical manual bottlenecks, giving Keystone and ELA credit unions an immediate advantage in delivering fast, friction-free loan fulfillment: a critical capability often lacking in legacy setups.

Frequently Asked Questions

Q: We already have a loan application tool or a modern LOS. Why do we need Narmi Lend?

Q: What if we’re not ready to switch our LOS?

Q: How does this compare to lending features offered by other digital banking providers?